Points to be remembered by the Tenant of the Property: Tax so deducted should be deposited to the Government Account through any of the authorized bank branches.ĭetailed procedure, list of Bank branches authorized to accept TDS and Frequently Asked Questions (FAQs) are available on this website for reference. Section 194-IB of the Income Tax Act, 1961 states that for all the transactions with effect from June 1, 2017, tax 5% or 3.75% should be deducted (depending upon the Date of Payment/Credit to the Landlord) by the Tenant/ Lessee/ Payer of the property at the time of making payment of rent (to Landlord / Lessor/ Payee). Refunds and other taxes will also be available in AIS.As per Finance Act, 2017, “TDS on Rent” under section 194-IB is liable to be deducted by Individuals or HUFs (Hindu Undivided Family) (other than an individual or a HUF, whose total sales, gross receipts or turnover from the business or profession carried on by him exceed the monetary limits specified under clause (a) or clause (b) of section 44AB during the financial year immediately preceding the financial year in which such income by way of rent is credited or paid) responsible for paying to a resident monthly rent exceeding ₹ 50,000. Note-: There is only TDS/TCS data displayed in Form 26AS for AY 2023-24 onwards. It is important for taxpayers to cross-check the TDS certificates such as Form 16/Form 16A vis-à-vis Form 26AS and AIS.

You can click on the Export as PDF button to save it in PDF format. Then click on "View / Download" to view your Form 26AS Select the desired Assessment Year from the drop-down and click on View as (HTML, Text).

Click on " View Tax Credit (Form 26AS)" to view your Form 26ASĦ. Select the check box for "I agree to the usage and acceptance of Form 16 / 16A generated from TRACES" as shown in the below image and click on "Proceed"ĥ. You will be redirected to the TDS-CPC website, Click on the " Confirm" button to proceedĤ.

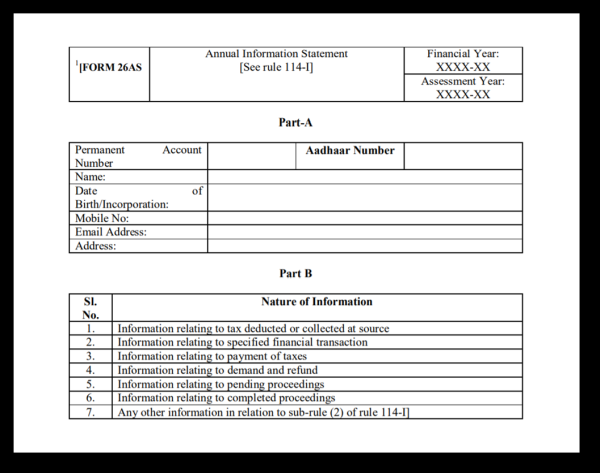

Go to " e-File “ > Income Tax Returns > View Form 26AS"ģ. Click here to visit the login page and log in to your accountĢ. Log in to Income-tax Department's website. Following are the steps to view/download Form 26AS: 1. In addition to using Form 26AS, you can also claim the tax credit. Of the various things that you need to look into during filing your returns, Form 26AS is very crucial. On the income tax website, you can easily access Form 26AS, which is your annualized tax statement in a consolidated form.įorm 26AS contains all the income-related details that TDS is collected and paid on your behalf. Income-tax return filing is not all that complicated if we spend some time upfront. The Income-tax return filing season is something that a lot of us do not take seriously until it is upon us.

0 kommentar(er)

0 kommentar(er)